MPC slams the brakes on its rate cut cycle

Sanjay Malhotra, Governor of the Reserve Bank of India

| Photo Credit:

DHIRAJ SINGH

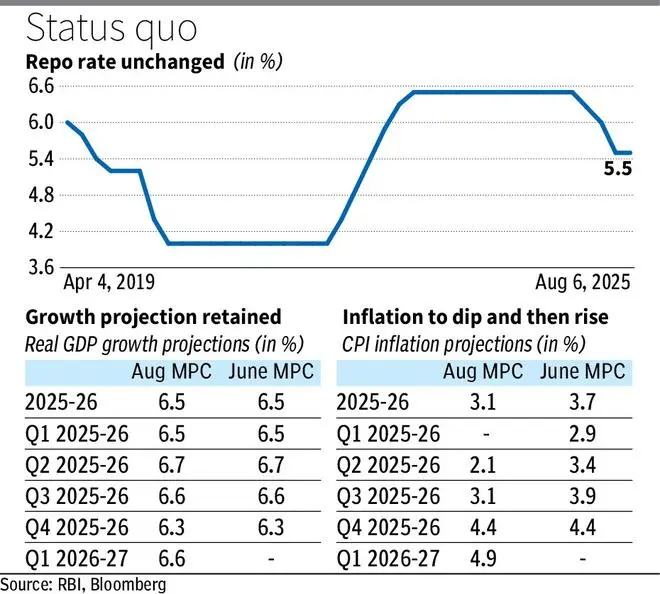

After front-loading rate cuts, cumulating 100 basis points during the February-June 2025 period, the RBI’s six-member rate-setting panel slammed the brakes on its current rate cut cycle.

The hawkish pause on the repo rate came amid possibility of inflation edging up above the MPC’s 4 per cent target from the fourth quarter, continuing transmission of earlier rate cuts to the broader economy, and prospects of external demand remaining uncertain due to the steep 25 per cent tariff slapped by President Trump on Indian imports into the US (and its depreciating effect on the Rupee).

Rate pause

In a move that was widely expected, all six members of the RBI’s monetary policy committee (MPC) voted to keep the policy repo rate (the interest rate at which Banks borrow funds from RBI to overcome short-term liquidity mismatches) unchanged at 5.50 per cent. They also decided to continue with the neutral stance.

It may be pertinent to mention here that RBI Governor Sanjay Malhotra recently observed that the change in the monetary policy stance to neutral (from accommodative) in the June bi-monthly policy review, along with the 50 basis points repo rate cut, indicates that the bar for further easing is higher than it would have been if the stance was accommodative.

Inflation insight

On Wednesday, he said: “The MPC noted that, while headline inflation (at a 77-month low of 2.1 per cent in June) is much lower than projected earlier, it is mainly due to volatile food prices, especially of vegetables.

“Core inflation, on the other hand, has remained steady around the 4 per cent mark, as anticipated. Inflation is projected to go up from the last quarter of this financial year.”

The Governor noted that domestic growth is holding up and as per earlier projections though below RBI’s aspirations (of 6.5% plus).

Further, the uncertainties of tariffs are still evolving and monetary policy transmission of the 100 bps repo rate cut into the lending and deposit rates is continuing.

“On balance, therefore, the current macroeconomic conditions, outlook and uncertainties call for continuation of the policy repo rate of 5.5 per cent and wait for further transmission of the front-loaded rate cut to the credit markets and the broader economy,” Malhotra said.

Rating agency ICRA, in a note, said with unchanged rates in this meeting, it anticipates that an extended pause is now underway.

“By the time the data starts showing a slowdown in quarterly GDP growth prints (Q3 print to be released at the end of February 2026), inflation will likely have normalised to above 4 per cent.

“This is likely to constrain further monetary easing, going ahead. Bond yields seem to concur with the expectations of a continued pause, with the 10-year yield having risen after the policy statement,” according to the note

Nuvama Wealth said the yield of the 10-year benchmark Government Security (6.33% GS2035) hardened 9 bps to close at 6.42 per cent vs the previous close of 6.33 per cent, likely driven by the absence of dovish cues or no clarity on future rate cuts in the policy announcement.

Kaushik Das, Managing Director, Chief Economist – India, Malaysia and South Asia, Deutsche Bank, observed that it is better to hold the policy rate at the current juncture, given the prevailing unprecedented uncertainty regarding tariff negotiations and also considering that the MPC delivered a front-loaded 50bps rate cut in the June policy, which was higher than market expectations.

“We characterise today’s action as a “prudent hold” from a patient and forward-looking MPC….We now pencil in one more 25 bps cut in the 1st October policy under our baseline scenario, taking down the repo rate to 5.25%, while keeping short-term rates aligned to the repo rate,” he said.

Meanwhile, the RBI has cut its CPI inflation projection for FY26 to 3.1 per cent from the 3.7 per cent projected earlier, even as it retained the real GDP growth at 6.5 per cent.

The central bank also estimated CPI inflation for Q1FY27 at 4.9 per cent, which is abover than the MPC’s target of 4 per cent.

Published on August 6, 2025